1. digitalization as a driver of change in business models

What steps should banks take to effectively and sensibly address the developments of the digital age? Is the hype surrounding fintech service providers just hype? How should we deal with the discussions about Generation Y or Z? Is a radical restructuring of your own business model necessary or will an adaptive adjustment suffice? What is the right digitalization strategy for banks? This article provides a framework for analyzing these issues for the financial sector. Digitization is a generic term for electronic network-based exchange relationships. The authors define the digitalization of economic relationships as the mediation and support of economic relationships via network technologies. These relationships include the creation, transformation process and redefinition of value-creating relationships within and between organizations (business to business) and between organizations and private individuals (business to consumer).

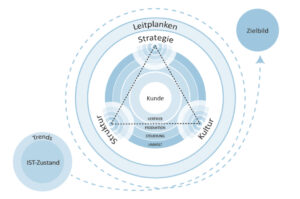

The average lifespan of companies represented in the S&P 500 Index has fallen from 67 to 15 years in recent decades. This shows by way of example that competition in the digital age allows strategic success positions to be identified much more quickly. This era is characterized by the technological possibility of receiving information at any time, regardless of location, channel and device. This “unlimited” access to information is a paradigm shift that makes intermediation and thus many business models superfluous and leads to decreasing forecasting horizons. The new technologies also enable existing customer needs to be met more precisely and new – also cross-sector – combination options to cover customer needs. This increases the pressure on margins even further, as such tailor-made offers do away with the unnecessary elements of previous solutions. Sustainable USPs therefore require the ability to consistently focus on customer needs. These developments are also leading to growing uncertainty with regard to sustainable management concepts. The Zurich model provides an orientation framework for the digitalization of business models.

Fig. 1: The Zurich model as an orientation framework for the digitalization of banks

Source: Auge-Dickhut, S. & Koye, B. (2015). Client Value Generation – Redesigning digital business models from the customer’s perspective. Handelsblatt Journal, 2015 (November), 20.

In summary, the Zurich model offers four guidelines as a framework for redesigning banks’ business models. Resilient companies are characterized by their ability to permanently learn and change along these guidelines.

- The development of sustainable USPs in the digital age requires the ability to constantly monitor the development of customer needs and derive customized solutions in real time.

- Strategic planning is a permanent iteration process.

- Structures must be designed to be agile and network-compatible.

- The corporate culture must enable an interlinked & partnership-based solution orientation and also establish it through appropriate incentive & control logics.

The core of digitalization is therefore the consideration of all elements of a business model from the perspective of customer needs. Trends are constantly (re)evaluated from the customer’s perspective; methods such as a customer journey and design thinking are basic prerequisites for the development of customer-centric solutions and strategies, which are also further developed in a modular manner. The growing transparency reduces margins, in some cases dramatically. Since 2017, for example, ‘all-round household insurance’ has been offered in Switzerland for young people at a fraction of the previous package price of all included product components. In monetary terms, a young person can purchase this solution for CHF 10 – and the old package price was CHF 500. This corresponds to a 98% loss in sales volume. These developments are only just beginning and are forcing providers to significantly increase efficiency and implement efficient structures. The basic procedural prerequisite for digitalization is therefore the effective industrialization of business processes – in other words, standardization, automation and a consistent willingness to focus on core competencies. This in turn requires a clear understanding of the necessary activities in each step of the value creation process and a precise coordination of responsibilities and roles along the processes as part of a ‘RACI’ matrix.

2. network capability as a core aspect of agile business models

The challenges for companies in the digital age are manifold – the days of guaranteed success are definitely a thing of the past. In this context, resilience reflects the ability to absorb disruptive changes and actual shocks and to transform their structures and activities towards sustainable business models against this backdrop and under long-term stress, high pressure to change and uncertainty. In this context, agility is the ability of an organization to act flexibly, actively, adaptably and with initiative in times of change and uncertainty. Network capability is a decisive criterion here. (Auge-Dickhut, S., Koye, B. et al., Resilienz im Banking, 2017).

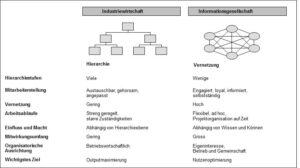

On the one hand, digital technologies enable the organization of exchange relationships in networks, both across company boundaries and within organizations, and on the other hand, an ever faster and more transparent exchange of information. Network capability increases the opportunities for interaction and cooperation between companies and between individuals. The participants form a network that enables each individual to invest only in those core activities in which they can effectively generate added value. The basic prerequisite for a functioning network landscape is a clear understanding of the necessary activities in each step of the value creation process and a precise coordination of responsibilities and roles between the network partners along the processes as part of a ‘RACI’ matrix.

Networks are ‘critical mass systems’. If a critical mass of users is reached – the so-called crossroads of diffusion development – then a product or service becomes established on the market. Typical examples include the search engine Google or the messenger service WhatsApp. This also explains the observable “the-winner-takes-it-all” effect with intermediaries such as online retailers or comparison portals. As a rule, only very few providers prevail. In addition, the interconnectivity of the offerings is of great importance. A product or service becomes more valuable in the network if it is compatible with those of other providers – this is referred to as network externality. Networks release positive external effects: the total value increases with each additional unit produced. All in all, these effects lead to an agile specialization of all market participants, because only those who can permanently maintain their added value in the network will remain successful.

Networks can be seen as a response to the initial situation, which is characterized by uncertainty and major risks. It is therefore important to develop agile and modular business models and to make company boundaries network-compatible. However, digitalization not only has an influence on the development of the exchange relationship via networks on the market, but also has an impact on the internal organizational development of companies. The softening of existing hierarchies and structures requires a culture of trust and the development of an entrepreneurial, solution-oriented and partnership-based attitude among all employees and managers. Both customers and employees are increasingly better informed and often also more committed. Recognition is increasingly created through personal value contributions & know-how. Only employers who enable networked and autonomous work remain attractive. It is therefore important to develop a corresponding incentive and management logic and to make use of existing instruments for interlinking employees – e.g. internal knowledge platforms and agile project collaboration tools. Every area of the existing business models is called upon to shape its added value in the digitizing value chain more efficiently and effectively than market solutions allow.

Figure 2: Roadmap for internal network capability

Source: Koye, B. (2005). Private banking in the information age: An analysis of strategic business models. S. 46

3. development stages of the network ecosystems of financial services

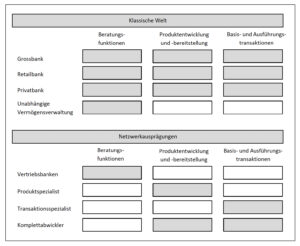

The above-mentioned effects also apply to the banking sector. The banking business is under pressure because many existing USP components are based on intermediation. Bank customers are less and less willing to pay for the pure provision of financial information by banks. Falling margins and additional regulatory requirements are forcing the industry to successively focus on efficiency. However, this alone will not be enough to meet the challenges of digitalization. Digitalization is undermining previous successful positions and also offering numerous competitors – including those from outside the industry – the opportunity to occupy at least parts of the value chain. The gradual development of the network capability of financial service providers can be divided into three phases.

In the first phase, a traditional provider can consistently analyze its existing value chain under the premise of core competencies and focus on the customer interface, production or processing or develop efficiency gains through cooperation with other banks. The use of modern technologies makes membership in such networks possible, and a good image can attract many partners, which leads to the realization of economies of scale and economies of scope. Necessary core competencies are the use of technology and image management vis-à-vis the network partners.

Fig.3: Focus on core competencies

Source: Auge-Dickhut, S., Koye, B. et. al.(2014), Client Value Generation, p. 107.

End customer sales are handled by the focal network partner at the customer interface – the sales bank. He has modern consulting expertise and a strong brand reputation. The product specialist focuses on product development and manufacturing and distinguishes itself through independence and striving for the best-in-class positioning of its product. The network capability of the products is a necessary prerequisite for this strategy. The transaction specialist focuses on cost leadership in the processing of transactions. This business model realizes economies of scale and economies of scope by taking over and implementing the corresponding process components from asset managers who focus on client interfaces, which can be passed on to clients in the pricing. The full-service provider positions itself as a product developer and provider as well as a transaction processor.

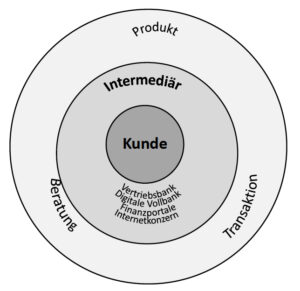

In the second phase, industry boundaries are increasingly blurred as part of specialization and new technology-driven and customer-oriented ecosystems are formed. In future, the customer interface will not necessarily lie with the banks, as the cooperation between FIDOR Bank and Telefónica shows. The account is opened and the contractual relationship is established via the telecom provider and the individual product components are combined. The term ‘interest’ is used, for example. higher data volumes. This is an example of the cross-sector & combined fulfillment of customer needs discussed theoretically above. However, the majority of fintech functionalities are still being integrated by the banks – e.g. the integration of Contovista’s Personal Finance Manager (PFM) at 6 banks in Switzerland or the offering from the winner of the Swiss Fintec Award 2017, Qumram. By acquiring a minority stake in Moneymeets, Postfinance wants to enable peer group comparisons and thus promote ‘community banking’ – the comparison with other customers when it comes to investments, financial investments or insurance issues. Glarner Kantonalbank, which already offers its Hypomat for two other partners (Fribourger KB and MoneyPark) in white labeling, is a good example of the development of new core competencies. Finally, FIDOR is a digital bank that enables other financial service providers to sell their products through FIDOR via the API interface of its core banking platform.

In future, the customer interface will be staffed by a wide variety of partners. Potentially, these are not only sales banks or full-service digital banks, which, for example, offer a wide range of services. without traditional branches, but also financial portals or Internet groups such as Facebook. This revealed the receipt of a banking license from Ireland in 2017 – initially in the area of payment transactions. As the discussion about the further development of Amazon’s business model as a logistics provider shows, this is just the beginning of the redefinition of customer interfaces.

Fig. 4: Customer interfaces & intermediaries

Source: Auge-Dickhut, S., Koye, B. et. al. (2014), Client Value Generation, p. 108

As an outlook, the likely third phase of developments in relation to digital financial ecosystems will be outlined here. Customers could, for example, have their financial needs met. can also be discussed and solved with modern systems such as WATSON from IBM with the aid of speech recognition. In the future, these AI (Artificial Intelligence) systems will presumably be able to identify and select the modular elements for implementing solutions independently.

4. options for the digital transformation of banks

In practice, three approaches can be distinguished with regard to the timing and organization of the digitalization of banks:

Integrated top-down digitization can be considered if management has a high level of agreement on the topic and internal resistance can therefore be channelled sensibly. Selected cross-bank reference initiatives are triggered in parallel and various areas are digitized in an integrated manner. Postfinance can be cited here as an example of an integrated digitalization strategy for all areas of value creation that was deliberately initiated by the management. In addition to the consistent development of electronic channels for traditional business, the whitelabelling of products for other providers and the simultaneous use of other products for the company’s own customers, new models such as crowdfunding are also consistently offered as loan financing on electronic platforms. But alsoThe actions of Zürcher Kantonalbank can be seen from this perspective. At ZKB, customer responsibility was consistently separated from channel responsibility by the management. Responsibility for all channels lies with the multichannel manager – as does the use of modern innovation methods.

However, digitalization can also be started in individual areas only, with the silos then being networked in a second step. Examples include the digitalization of the customer interface with a subsequent or parallel digitalization of selected processes – such as ‘digital onboarding’ or ‘mobile payment’ at many banks. Digitalization is also being driven forward in this way at UBS. On the one hand, the two front divisions ‘Switzerland’ and ‘International’ are working on digitalization with separate teams. On the other hand, there are autonomous innovation cells in the divisions that use modern innovation methods (Design Thinking & Customer Journey) together with the front-line managers for specific innovation developments and have to prove themselves in the internal market. Glarner Kantonlbank, Switzerland’s most digital bank in 2016, also chose this path by launching online sales in parallel to traditional sales without precisely clarifying the organizational responsibilities in advance. A frequently observed measure – also to raise awareness of digital topics among employees in the organization – is the launch of supplementary “speedboats”. One example of this is TWINT, which was developed as a cross-departmental reference project at Postfinance.

Another approach – especially for financially strong banks – is to outsource entire projects to innovation labs or incubators. There, these projects can be developed independently of existing structures and cultures. One example of a completely new development of a bank “on a greenfield site” is the successful online banking platform George of Erste Bank and the savings banks in Austria.

How do you strike a balance between focused further development of what already exists and a simultaneous focus on likely future success factors? In combination with digitalization, customer centricity and tailor-made strategic and organizational development from within are becoming the decisive dimensions in the realignment. It is the responsibility of each provider to develop its own path along the guidelines formulated here. At the customer interface, the ability to aggregate solutions precisely will be decisive, while economies of scale, the achievement of a critical size and economies of scope will have a significant influence on future industry structures in the other areas of the value chain. This is where the opportunity for differentiation lies for organizations and decision-makers.

Bibliography:

Auge-Dickhut, S., Butenkov, L., Domigos, N., Götz, C., Koye,B., (2017). Resilience in banking. 2017 (forthcoming).

Auge-Dickhut, S. & Koye, B. (2015). Client Value Generation – Redesigning digital business models from the customer’s perspective. Handelsblatt Journal, 2015 (November), 20-21.

Auge-Dickhut, S., Koye, B., Liebetrau, A. (2014). Client Value Generation – The Zurich model of client-centered bank architecture. Springer Gabler.

Koye, B. (2005). Private banking in the information age: An analysis of strategic business models. Bern: Paul Haupt Verlag (dissertation).